Energy Crisis in The World: Power Outages in China

2023-02-27

East Africa: an emerging LPG market

2023-02-28Gas price surpasses oil for the first time in 20 years

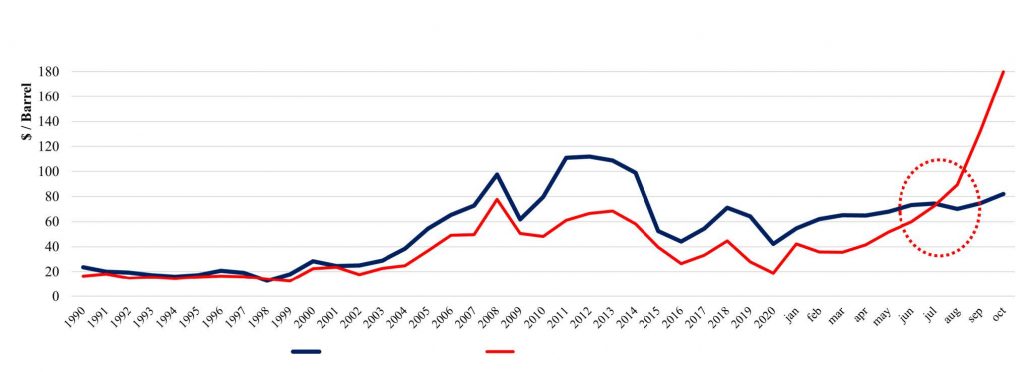

- In the last 2 months, the natural gas price, as the second most consumed fuel in Europe, has increased unprecedentedly, reaching an average of 100 cents per cubemate in October!

- Following the separation of gas market dynamics from the oil market, gas prices have surpassed oil for the first time in 20 years, and with oil prices hovering around $70 in recent months, European TTF hub prices have risen to around $ 180 per barrel.

Electricity and chemical products price doubled; Effects of the crisis

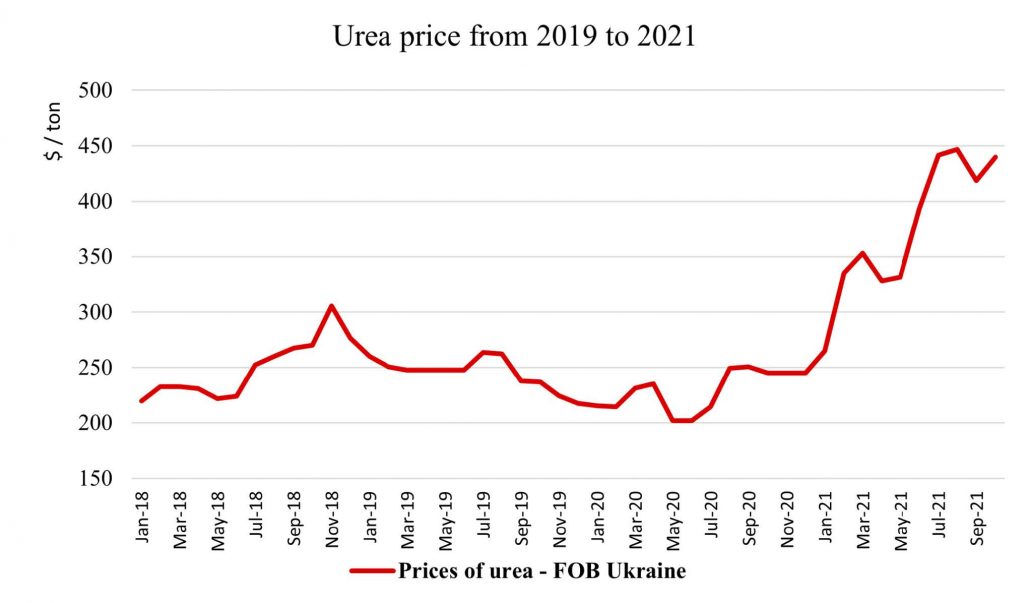

- Rising gas prices have particularly affected energy-intensive industries such as urea, shutting down many of them. One of the consequences of this spike in costs will be a severe disruption to the food supply chain in the coming months.

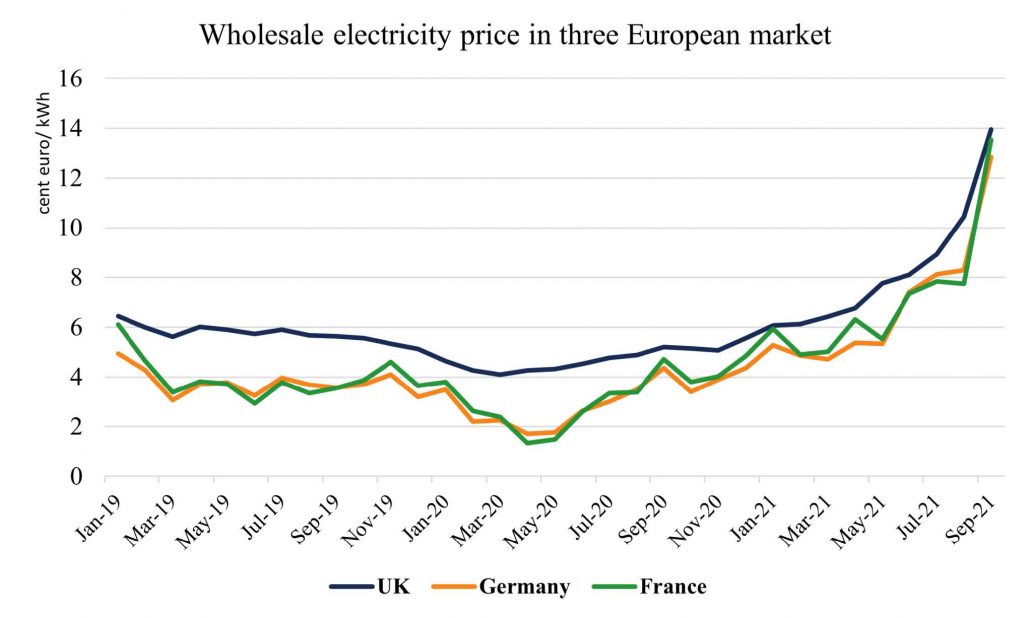

- The direct consequences of the gas crisis in the electricity sector are also evident, and this issue has become more pronounced in countries such as the Netherlands, Italy and the United Kingdom, where the share of gas in power generation is remarkable.

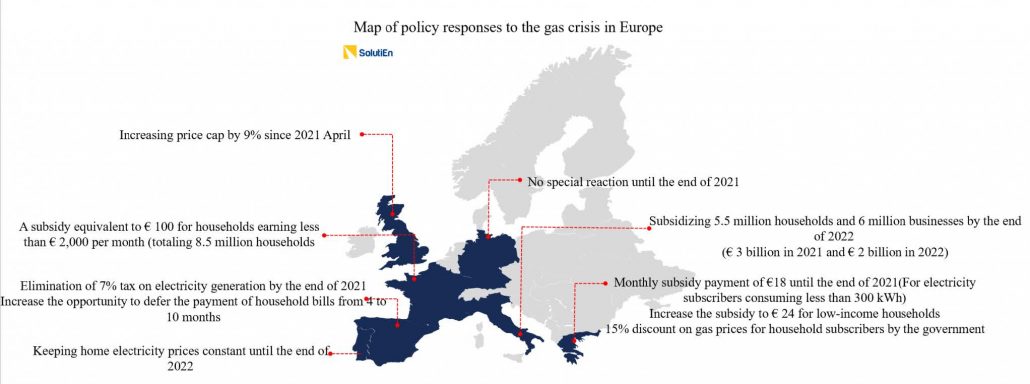

Policy response; Cash support for households

- Short-term solutions are based on protecting residential consumers from rising energy costs, including supporting subsidies to low-income consumers, delaying the payment of gas and electricity bills to consumers, and government and European Commission assistance to companies affected by the crisis.

What is Russia’s role in gas crisis?!

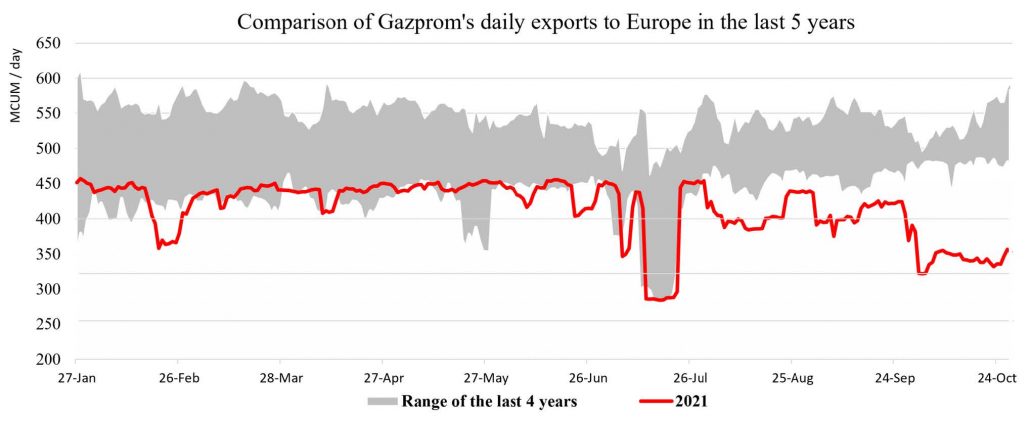

- Three factors have played a more serious role in creating the current crisis:

- Reducing the gas imports from Russia

- Inadequate storage due to factor 1 as well as declining domestic production in Europe(specifically Norway)

- Reducing the production of renewable electricity (wind) and thus increasing thedemand for natural gas

- As a result, demand for LNG spot shipments in Europe increased significantly, while due to the cold winter in East Asia and severe drought in South America, the majority of LNG shipments were purchased by Asian buyers (China, Korea and Japan) and Brazil.

Fragile market behavior; Results of turning to spot trading

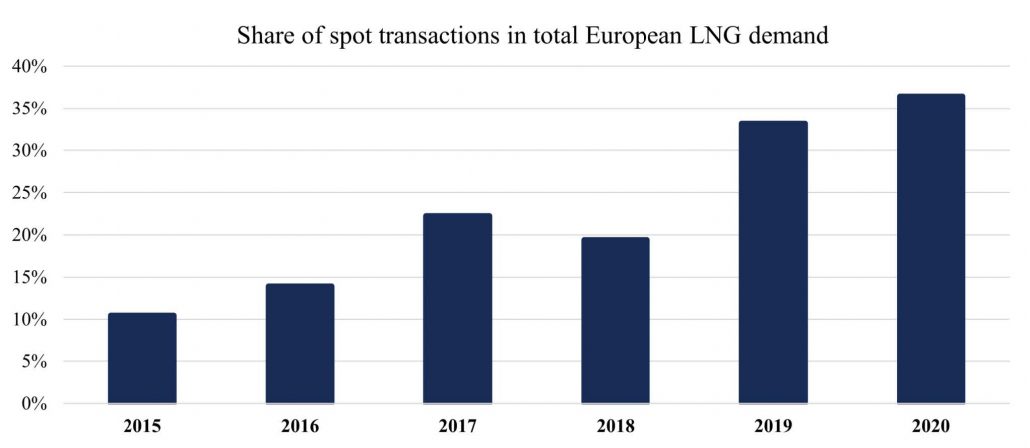

- In recent years, two strategies have been pursued simultaneously by European countries: 1- Increasing LNG imports and 2- Increasing the share of spot transactions in total gas import contracts.

- Vulnerability to market shocks is the nature of spot trading, which manifests itself in such crises. The shock of rising demand due to the recovery of countries’ economies plus climate shocks (unprecedented cold) have been two factors influencing the imbalance in the world LNG trading market.

- Europe, on the other hand, is in the middle of a transition to renewable energy in its energy portfolio, resources that are always facing uncertainty. Due to the increasing share of these resources in the European energy portfolio and the absence of sufficient investment in storage technologies, the current sharp fluctuations will certainly continue in the coming years.