Iran-Iraq Energy Trade: Threats to a Win-Win Situation

2023-02-27

Energy Crisis in The World: Gas shortage in Europe

2023-02-27The worst electricity crisis in 20 years, rationing even for

households

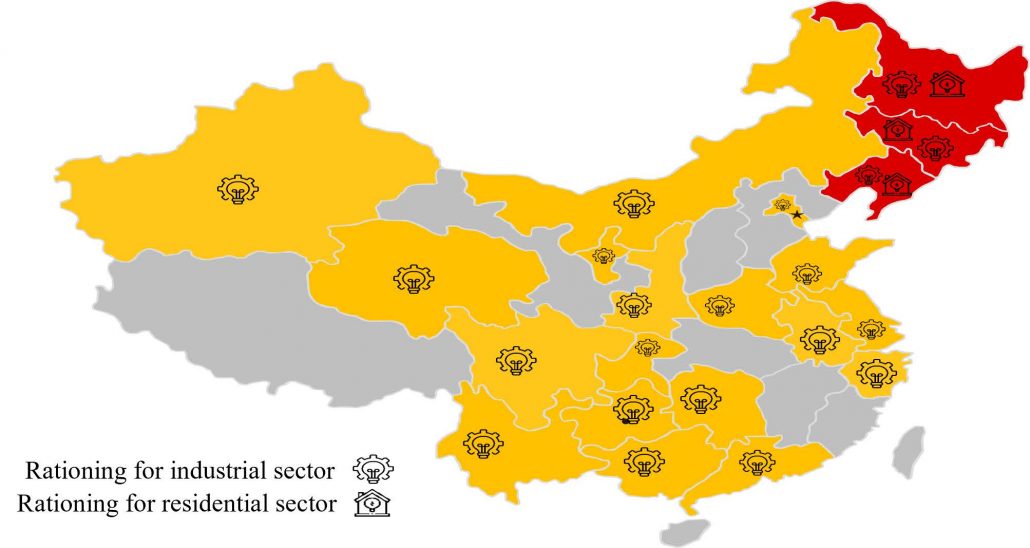

- Widespread power outages, which began in August 2021, have forced many factories and industries in the country to shut down. In 21 provinces (of 31 provinces) rationing began with the priority of industrial and commercial sector, and in three northeastern provinces of the country, it has also hit households.

- Despite a 14% increase in consumption in the first 8 months of 2021, electricity generation has increased by only 2.5%, the largest gap in 20 years.

- Due to a severe shortage of coal (as fuel for 70% of China’s power plants), it is expected that rationing will continue at least until spring 2022.

Electricity rationing map in China’s provinces in the last 2 months

Massive supply-chain disruptions in the world; Effects of the crisis

- The energy-intensive sectors (e.g. steel, cement and chemicals), while their share of electricity consumption is about 30%, are the most affected industries of these rationing. China’s steel production in Sep. 2021 has decreased by 2% compared to the previous month and 15% compared to the previous year.

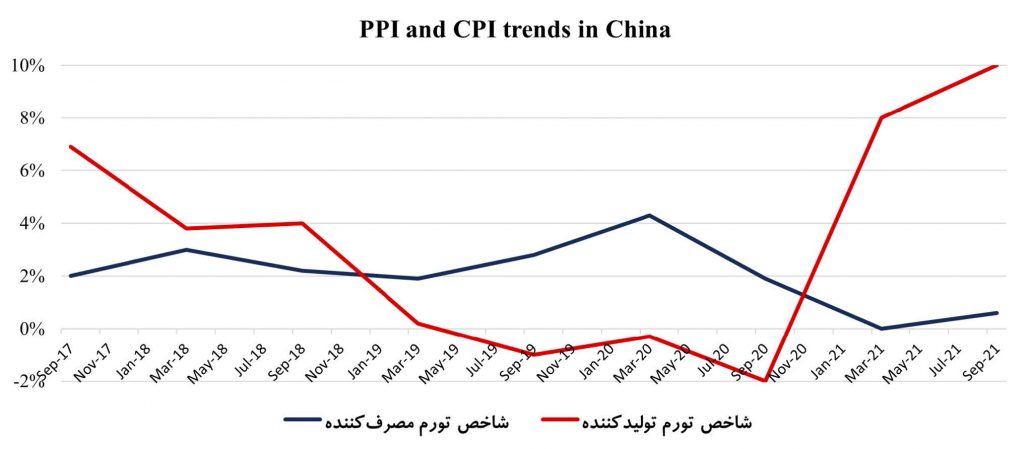

Approximately 45% of economic activities in China were affected by these rationing, and disruption of on-time supply of export orders is quite expected. Inflation in the manufacturing sector and sluggish economic growth are the main consequences of China’s blackouts in recent months, and Goldman Sachs estimates that the continuation of the power outage could reduce China’s GDP growth by 0.8%.

Increasing in demand and coal shortage ; Short-term causes

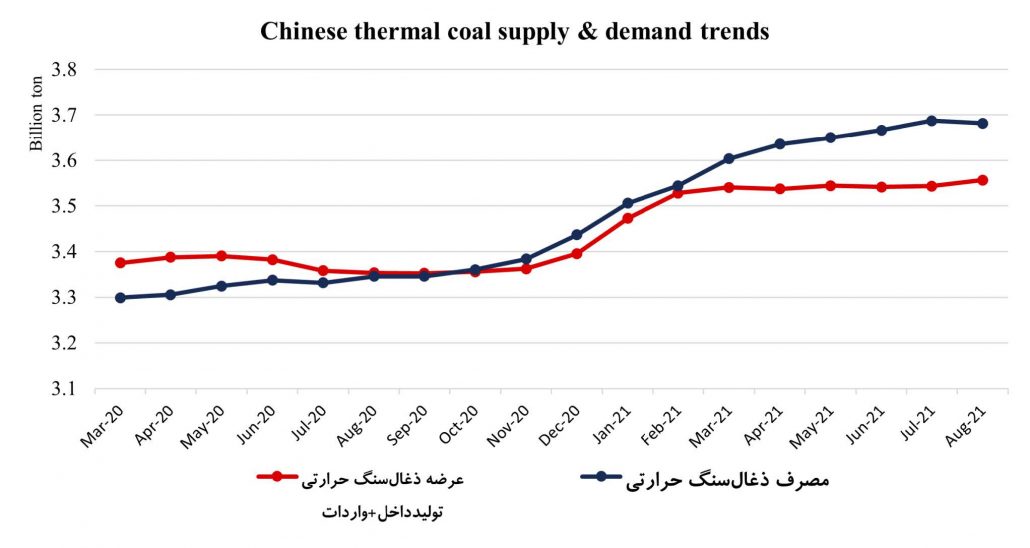

- Dependence on coal in China’s electricity generation has turned a small disruption incoal supply into a large deficit in the electricity sector. In the first six months of 2021,despite a 20% increase in coal consumption in power plants and industries such assteel, domestic production in the two main coal-producing provinces fell by about 20%.At the same time, imports also fell 10% due to China’s political challenge to Australiaand Indonesia’s declining exports.

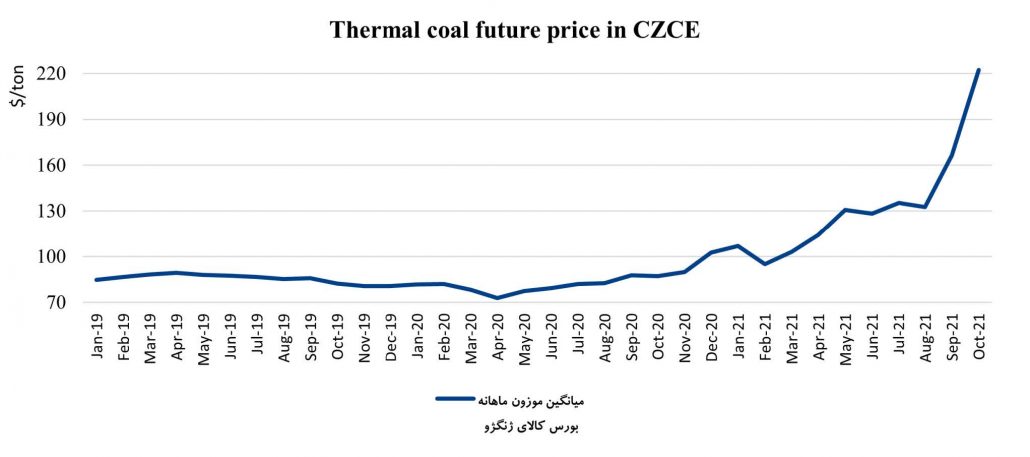

- The “about 120% rise in coal prices” and the “halving of power plant inventories” havebeen the result of the above-mentioned factors and the root cause of rationing andblackouts in recent weeks in China.

Defective pricing mechanism; Long-term causes

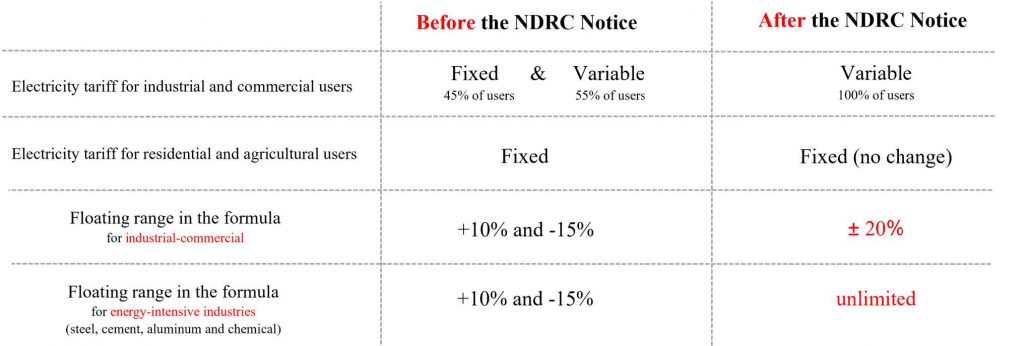

- The purchase price of electricity from thermal power plants in China is determinedunder a simple but mandatory mechanism in the form of “base price + fluctuation”. Thebase price is set based on a benchmark for the cost of producing thermal power plantsby the government. The fluctuation range is the percentage of change that can bedetermined by the regulators of each province and at their discretion in the range of-15% to + 10%. This mechanism started in late 2019, But it was announced that pricesshould not rise in 2020!

- While in mandatory pricing of electricity, the price of the coal, is determinedcompetitively.

The policy response; Elimination of the industrial sector from fixedtariffs

- Because of the power supply crisis in 2021, two options, “trying to supply more coal”and “raising electricity prices,” have been on the Chinese government’s agenda for thepast two months. Forecasting a 12% shortage of coal over the next five months, theregulator had no choice but to change the price, so on October 12, the NDRC issued anotice calling for a change in the rules for buying and selling electricity, which is calleda “major change“.

Conclusion

- The current electricity crisis has shown the inefficiency of the China’s electricity regulatory system. Despite the permission of each province to determine the range of fluctuations in 2021, and the escalation of coal prices in many provinces, this percentage had not changed until September! The fear of the policymakers of increasing production costs and decreasing investment, in the long run, has been the main obstacle for them to make decisions.

- From another angle of the crisis, China showed the hard way to achieve the goal ofreducing emissions by 2030 and zero emissions by 2060. The goals set in thecountry’s five-year plan were to reduce emissions by 3.5 percent by 2021, and failingto meet them in 19 provinces in the first six months, led them to suspend somefactories to cut production and emissions in recent months.

- According to rise of coal price after a decade of declining trends, Chinese policy makers face two options in the long run:

- Increase government investment in the development of alternative energy sources and reduce dependence on coal.

- Transfer of the burden of increasing the cost of electricity generation to industry and private investors, and consequently its potential effects on China’s economic growth.