New Energy NEWS

2022-01-31

Iran’s Natural Gas Imbalance_ A Statistical Presentation

2023-02-27THE NATIONAL IRANIAN OILCOMPANY’S ACTUAL SHARE OFOIL REVENUES

Vahid Parvizi and Vahid Parvizi in Tehran | SEPTEMBER 21 2023

The NIOC owns 14.5% on paper, but in reality 7%

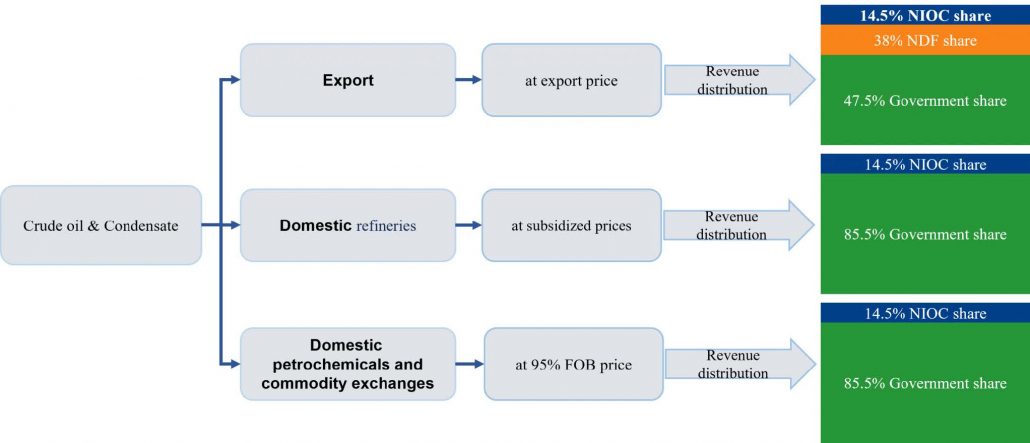

- Despite the 14.5% share of the NIOC in the crude oil and condensate revenue,considering the sale of half of the produced oil to domestic refineries, the company’sreal share of the value of oil and condensate produced in “non-sanctioned” conditionsis about 9% and in “sanctioned” conditions is about 7%.

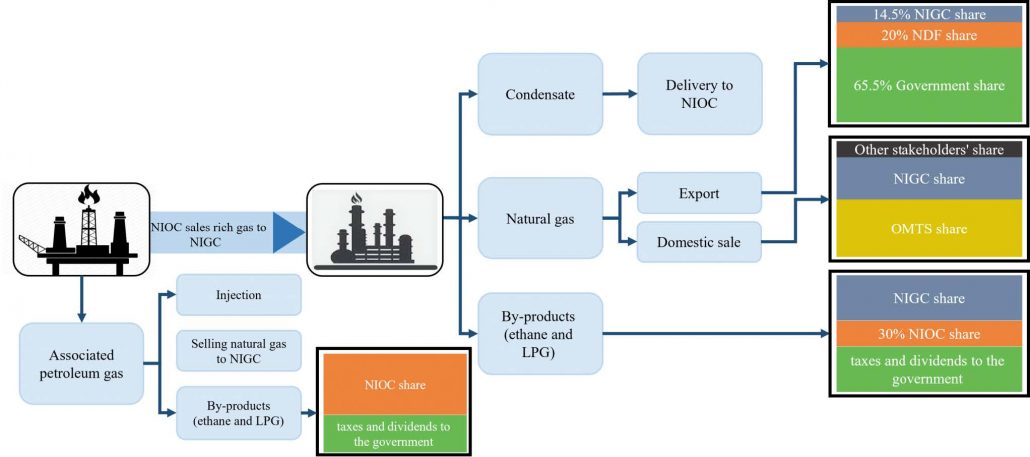

More complexities in the gas sector’s financial relationships

- The NIOC’s share from the Natural gas comes from two sources: selling rich gas to theNIGC for 30 Tomans (0.001 $ in 2021) and a portion of the ethane and LPG revenuegenerated after gas refining.

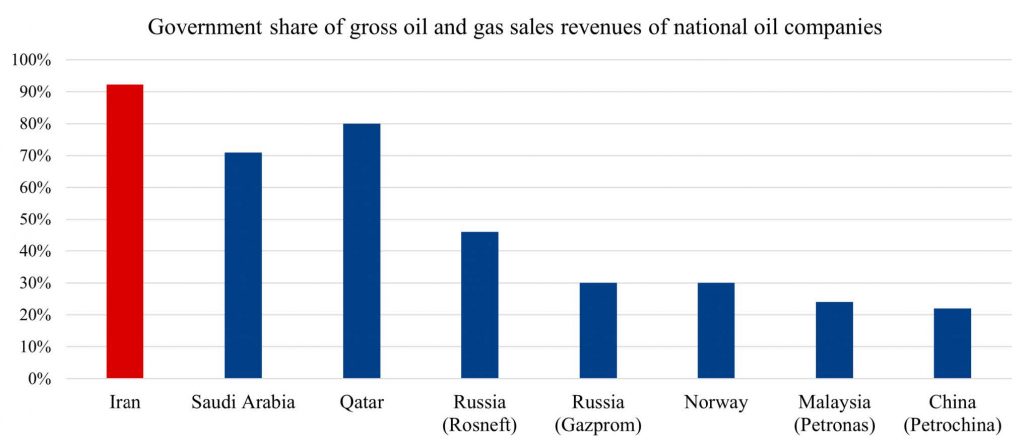

The biggest government’s share in oil income of any country in theworld

- The NIOC’s share in oil and gas production is 7.8% of the overall value of these products.

- The Iranian government owns more than 90% of the value of products, while Saudi Arabia owns 70%, Qatar owns 80%, and Russia (through Rosneft) owns 46% of totalproduction.

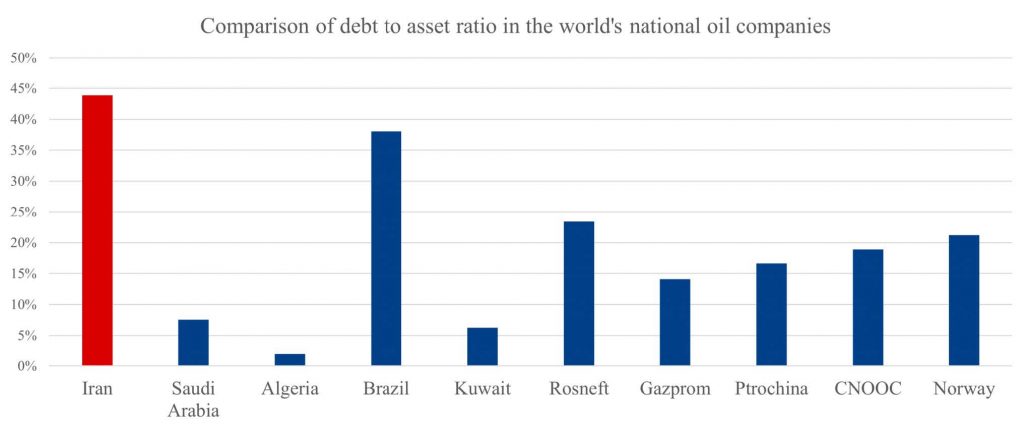

The NIOC; a major debtor among foreign competitors

- The NIOC’s low share has necessitated the usage of external funds for investment,resulting in a total debt of 66 billion dollars by the end of 2019.

- This company’s long-term debt to assets ratio is currently 44%, which is exceptionallyhigh when compared to other national oil companies around the world.

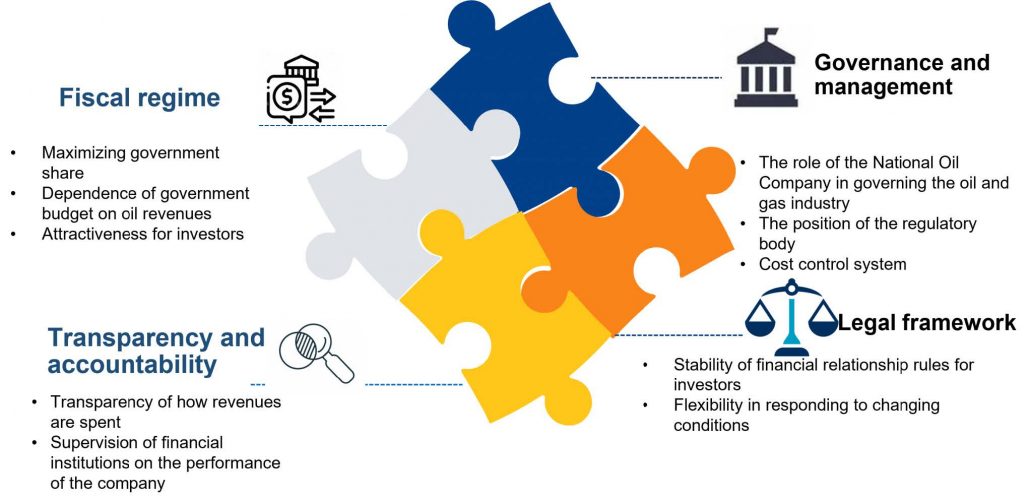

Different aspects of a good financial relationship

- The following four dimensions must be examined in order to build a proper financialconnection.

- Other issues that need to be addressed in the financial relationship reform includeannual changes in the company’s share in the annual budget, the government’s lack of business vision for the company, the lack of a regulatory system to monitor costs, andthe lack of transparency in the financial statements.